Utility deposit bonds are essential financial instruments in Indiana, especially for those looking to establish utility services without the burden of high upfront deposits. Understanding the nuances of these bonds can facilitate a smoother transition into new service agreements. This article will delve into the details of Indiana utility deposit bonds, including their purpose, benefits, and the application process.

What is a Utility Deposit Bond?

A utility deposit bond is a type of surety bond that serves as a guarantee to utility companies that the customer will pay for their services. Instead of paying a cash deposit upfront, customers can opt for a bond, which acts as a promise to cover any unpaid bills. This arrangement can be particularly beneficial for individuals or businesses with limited cash flow. By choosing a utility deposit bond, customers can free up their cash for other essential expenses, such as rent or operational costs, while still ensuring they have access to vital services.

How Does It Work?

When a utility deposit bond is issued, the bond company guarantees payment to the utility provider in case the customer defaults on their payment obligations. The customer pays a premium to the bond issuer, which is typically a fraction of the total deposit amount. If the customer fails to pay their utility bills, the utility company can claim the bond amount from the surety company. This process not only protects the utility provider but also allows customers to maintain their creditworthiness, as the bond does not require a large upfront cash payment.

Once the bond is claimed, the customer is responsible for reimbursing the surety company. This arrangement allows customers to manage their finances more effectively while still obtaining necessary utility services. Additionally, utility deposit bonds can often be renewed or adjusted based on the customer’s payment history, potentially leading to lower premiums over time as the customer demonstrates reliability in their payment habits.

Types of Utility Services Covered

Utility deposit bonds can cover a variety of services, including electricity, water, gas, and sometimes even telecommunications. Each utility company may have different requirements regarding the bond amount and terms, so it's essential to check with the specific provider for their policies. For instance, some companies may require a higher bond amount for commercial accounts compared to residential ones, reflecting the larger scale of service and potential liabilities involved.

Moreover, the specifics of the bond can vary significantly based on regional regulations and the financial stability of the utility provider. In some areas, customers may also have the option to negotiate the terms of the bond, allowing for greater flexibility in how they manage their utility expenses. Understanding the nuances of these bonds can empower customers to make informed decisions and choose the best financial strategies for their unique situations.

Benefits of Indiana Utility Deposit Bonds

Opting for a utility deposit bond in Indiana comes with several advantages. Understanding these benefits can help individuals and businesses make informed decisions when establishing utility services.

Lower Initial Costs

One of the most significant benefits of a utility deposit bond is the reduced initial costs. Instead of paying a large cash deposit, customers only need to pay a small percentage of the total deposit amount as a premium for the bond. This can free up cash for other essential expenses, making it easier to manage finances. For example, a small business owner might use the funds saved from not having to pay a hefty deposit to invest in inventory or marketing, which can ultimately lead to increased revenue.

Improved Cash Flow

By utilizing a utility deposit bond, customers can maintain better cash flow. This is particularly advantageous for businesses that may have fluctuating income or seasonal expenses. The ability to allocate funds to other areas of the business can lead to improved operations and growth opportunities. Additionally, individuals can benefit from this arrangement, as it allows them to redirect their finances toward urgent needs such as home repairs or education expenses, rather than tying up their money in utility deposits.

Enhanced Flexibility

Another notable advantage of utility deposit bonds is the flexibility they offer. Unlike traditional cash deposits, which can be a one-time financial burden, utility deposit bonds can be structured in a way that aligns with the customer's financial situation. This means that businesses and individuals can choose payment plans that suit their cash flow cycles, allowing them to manage their budgets more effectively. Furthermore, the bond can often be renewed or adjusted based on changing needs, providing an adaptable solution for long-term utility service requirements.

Credit Building Opportunities

Utility deposit bonds also present an excellent opportunity for individuals and businesses to build or improve their credit. By securing a bond and maintaining timely payments, customers can demonstrate their reliability and financial responsibility to credit reporting agencies. This positive payment history can contribute to a higher credit score, which may lead to better financing options in the future, such as lower interest rates on loans or improved terms on credit lines. For new businesses, establishing a solid credit profile early on can be crucial for long-term success and stability in a competitive market.

Eligibility Requirements

While utility deposit bonds offer numerous benefits, not everyone may qualify for them. Understanding the eligibility requirements is crucial for potential bond applicants.

Creditworthiness

Most surety companies will assess the creditworthiness of the applicant before issuing a utility deposit bond. A strong credit score can significantly increase the chances of approval and may result in lower premium rates. Conversely, individuals or businesses with poor credit may face higher premiums or be denied coverage altogether. It's important for applicants to review their credit reports beforehand and rectify any discrepancies that could negatively impact their score. This proactive approach can not only enhance their chances of securing a bond but also improve their overall financial health.

Business vs. Residential Applicants

Eligibility requirements may differ for residential and business applicants. Businesses often face stricter scrutiny due to the larger amounts involved and the potential impact of non-payment on the utility provider. Residential applicants may have a more straightforward process, but creditworthiness still plays a crucial role. Additionally, businesses may be required to provide financial statements, proof of operational history, and other documentation to demonstrate their ability to meet utility obligations. This added layer of assessment helps surety companies mitigate risk, ensuring that they issue bonds to applicants who are financially stable and capable of fulfilling their commitments.

Additional Considerations

In addition to creditworthiness and the distinction between business and residential applicants, other factors can influence eligibility for utility deposit bonds. For instance, the type of utility service being requested can play a role; certain utilities may have more stringent requirements based on their risk assessments. Furthermore, geographical location can also impact eligibility, as some regions may have different regulations or market conditions that affect the bonding process. Applicants should be prepared to provide any additional information that may be requested by the surety company, as this can streamline the approval process and help them secure the bond they need.

How to Apply for an Indiana Utility Deposit Bond

The application process for a utility deposit bond in Indiana is relatively straightforward, but it requires careful attention to detail. Here’s a step-by-step guide to help navigate the process.

Step 1: Research Surety Companies

Begin by researching various surety companies that offer utility deposit bonds in Indiana. Look for reputable companies with positive reviews and a solid track record. It's essential to compare rates and terms to find the best fit for your needs. Additionally, consider reaching out to local business associations or financial advisors who may have insights into reliable surety providers. Their recommendations can be invaluable in making an informed choice, as they often have firsthand experience with the companies' services and customer support.

Step 2: Gather Necessary Documentation

Before applying, gather all necessary documentation, including proof of identity, financial statements, and any relevant information about your utility provider. Having these documents ready can expedite the application process. It's also wise to prepare a brief business plan or summary of your financial health if you are applying as a business entity. This information can help the surety company better understand your situation and may improve your chances of approval. Additionally, ensure that all documents are current and accurately reflect your financial status to avoid any discrepancies during the review process.

Step 3: Submit Your Application

Once you have selected a surety company and gathered the necessary documentation, submit your application. Be sure to provide accurate and complete information to avoid delays. After submission, the surety company will review your application and assess your creditworthiness. This assessment may involve a credit check, so it’s beneficial to check your credit report beforehand and address any issues that could negatively impact your application. Depending on the company, you may also be required to provide additional information or clarification during this review phase, so be prepared to respond promptly to any requests from the surety company.

Costs Associated with Utility Deposit Bonds

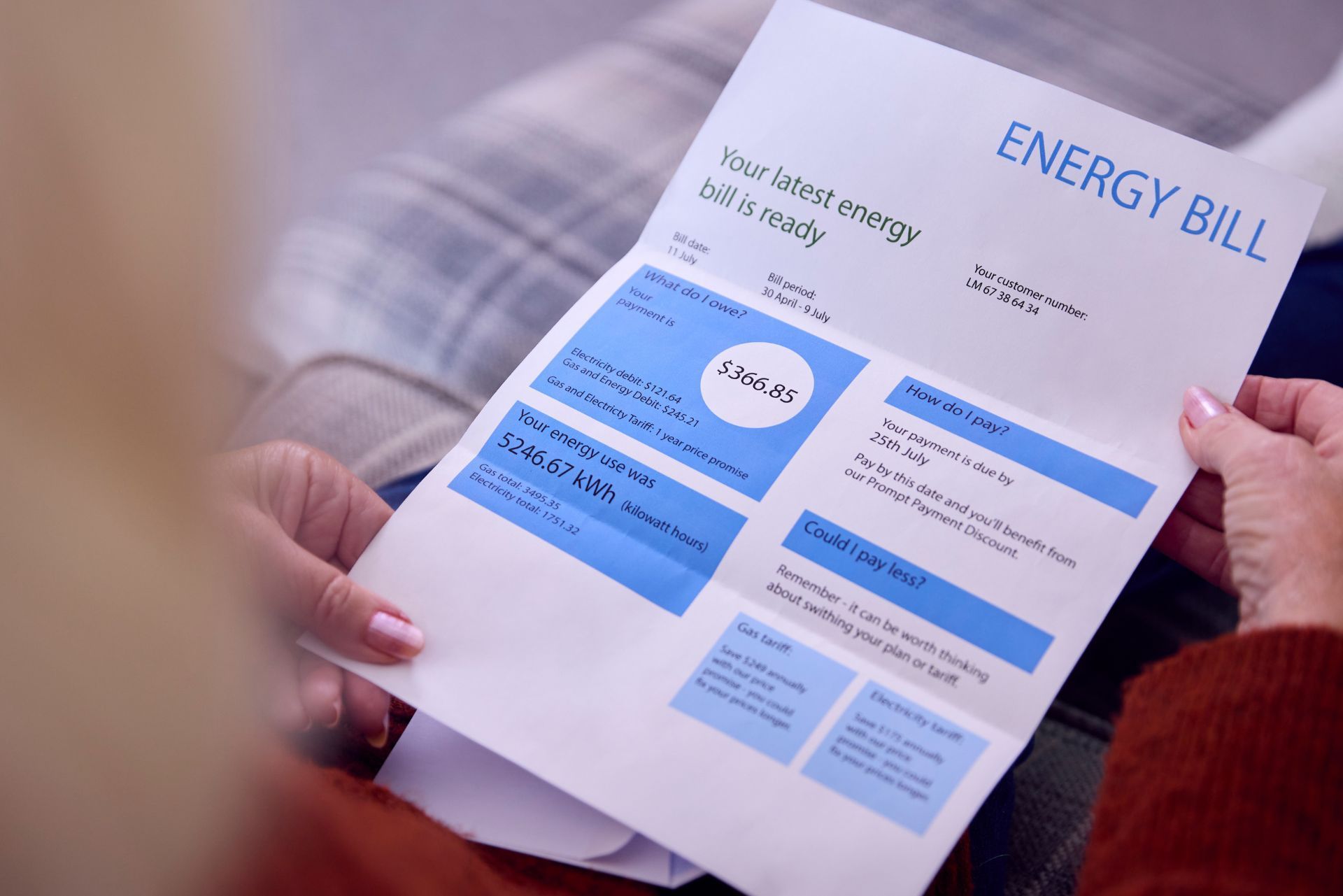

Understanding the costs associated with obtaining a utility deposit bond is crucial for budgeting purposes. While the initial premium may be lower than a cash deposit, there are other factors to consider.

Premium Rates

The premium for a utility deposit bond typically ranges from 1% to 15% of the total bond amount, depending on the applicant's creditworthiness and the surety company’s policies. Those with better credit scores can expect to pay lower premiums, while individuals or businesses with poor credit may face higher rates. It's worth noting that some surety companies may offer discounts for long-term clients or for those who bundle multiple bonds, which can significantly reduce overall costs.

Additional Fees

In addition to the premium, some surety companies may charge administrative or processing fees. It’s essential to inquire about any additional costs upfront to avoid surprises later in the process. Understanding the total cost of the bond will help in making an informed decision. Furthermore, some companies may also impose renewal fees if the bond needs to be extended beyond its initial term, which is another aspect to consider when budgeting for utility deposit bonds.

Potential Refunds and Claims

Another important aspect to consider is the potential for refunds or claims against the bond. In many cases, if the bond is not claimed against during its term, the premium may be non-refundable. However, certain surety providers may offer a partial refund if the bond is canceled early or if the utility company releases the bond after a specified period. This can provide some financial relief, making it essential to understand the terms of the bond thoroughly before committing.

Impact of Bond Amount

The total amount of the utility deposit bond also plays a significant role in the overall costs. Higher bond amounts typically lead to higher premiums, which can strain budgets, especially for small businesses or individuals. Therefore, it is advisable to assess the necessity of the bond amount requested by the utility provider and explore if a lower amount could suffice. Additionally, some utility companies may allow for a phased approach to deposits, which could help in managing cash flow while still securing the necessary services.

Common Misconceptions About Utility Deposit Bonds

Despite their benefits, utility deposit bonds are often misunderstood. Addressing these misconceptions can provide clarity for potential applicants.

“I Don’t Need a Bond if I Have Good Credit”

While having good credit can improve the chances of obtaining a bond and securing lower premiums, it does not eliminate the need for a bond altogether. Utility companies often require a bond as part of their policies, regardless of the applicant's credit history. This requirement serves as a form of security for the utility provider, ensuring that they have a financial safety net in case of non-payment. Furthermore, even individuals with stellar credit may find that a bond can enhance their relationship with service providers, demonstrating a commitment to fulfilling their financial obligations.

“Utility Deposit Bonds Are Only for Businesses”

This misconception is prevalent, but utility deposit bonds are available for both residential and commercial customers. Individuals can benefit from these bonds just as much as businesses, especially when trying to manage cash flow effectively. For instance, renters or homeowners who are moving into a new property may be required to secure a bond to cover potential utility costs, allowing them to avoid hefty upfront deposits. Additionally, these bonds can provide peace of mind, as they protect both the utility company and the customer from unexpected financial burdens, making them a practical choice for anyone looking to establish or maintain utility services.

“The Process to Obtain a Utility Deposit Bond is Complicated”

Many potential applicants shy away from utility deposit bonds due to the belief that the application process is lengthy and complex. In reality, obtaining a bond can be quite straightforward. Most surety bond providers offer online applications that simplify the process, allowing applicants to submit necessary documentation and receive quotes quickly. Additionally, many providers have dedicated customer service teams to assist applicants through each step, ensuring that all questions are answered and concerns addressed. This streamlined approach not only saves time but also empowers individuals to secure the bonds they need without unnecessary stress.

Frequently Asked Questions

As with any financial instrument, questions often arise regarding utility deposit bonds. Here are some of the most common inquiries.

Can I Cancel My Utility Deposit Bond?

Yes, utility deposit bonds can typically be canceled. However, it’s essential to check with the surety company regarding their cancellation policy. There may be specific conditions or fees associated with cancellation, so understanding these terms is crucial.

What Happens If I Default on My Utility Payments?

If you default on your utility payments, the utility company can make a claim against the bond. The surety company will then pay the utility provider up to the bond amount. However, the customer will be responsible for repaying the surety company for any claims made.

Conclusion

Indiana utility deposit bonds provide an excellent alternative for customers looking to establish utility services without the burden of a large cash deposit. Understanding the mechanics, benefits, and application process of these bonds can empower individuals and businesses to make informed financial decisions. By opting for a utility deposit bond, customers can enjoy improved cash flow and reduced initial costs, making it a practical choice in today’s economic landscape.

Before proceeding, it is advisable to conduct thorough research and consult with professionals to ensure that the chosen path aligns with individual financial circumstances. With the right information and preparation, obtaining a utility deposit bond can be a straightforward and beneficial process.

Article By: Ryan Spalding

Licensed Insurance Agent & Bond Specialist

Contact Us