In the vibrant state of Florida, utility deposit bonds play a crucial role in the relationship between utility companies and consumers. Whether you're moving into a new home or starting a business, understanding the ins and outs of utility deposit bonds can save you time, money, and stress. This article will explore everything you need to know about Florida utility deposit bonds, including their purpose, how they work, and the steps involved in obtaining one.

What is a Utility Deposit Bond?

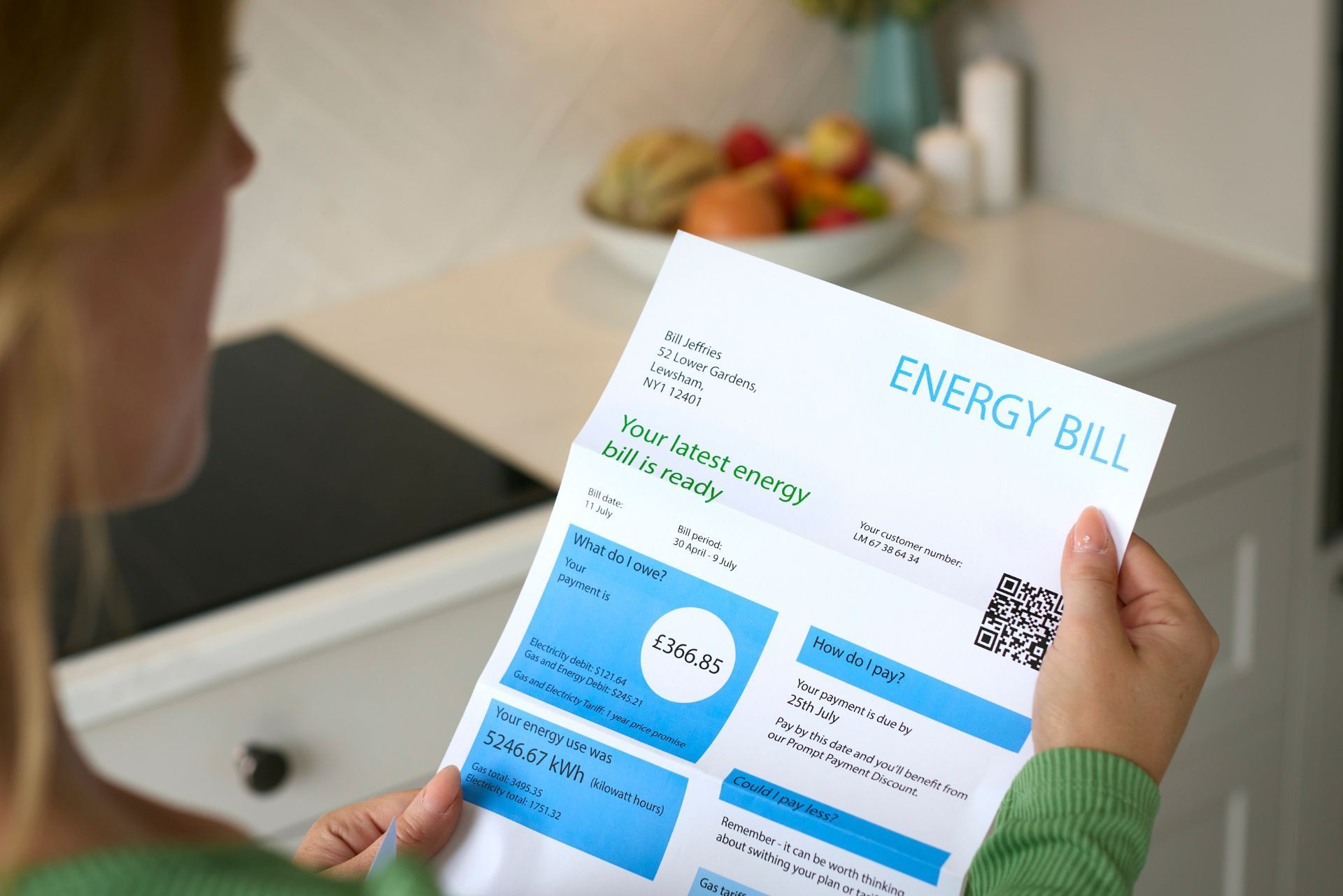

A utility deposit bond is a financial guarantee that a consumer provides to a utility company. This bond assures the utility provider that they will receive payment for services rendered, even if the consumer fails to pay their utility bills. In Florida, utility deposit bonds are often required for new customers, especially those with a limited credit history or previous payment issues.

Unlike a cash deposit, which ties up funds that could be used for other purposes, a utility deposit bond allows consumers to secure their utility services without a significant upfront payment. Instead, the bond functions as a promise to pay, backed by a surety company that issues the bond. This flexibility can be particularly appealing for individuals who are managing tight budgets or unexpected expenses, as it provides a way to maintain essential services without the burden of a large cash outlay.

How Does a Utility Deposit Bond Work?

When a consumer applies for a utility deposit bond, they typically work with a surety company that assesses their creditworthiness. If approved, the surety company issues the bond, and the consumer pays a premium, usually a percentage of the bond amount. This premium is non-refundable and serves as the surety company's fee for providing the bond. The process is generally straightforward, allowing consumers to quickly establish their utility services while minimizing the financial strain often associated with traditional deposits.

In the event that the consumer fails to pay their utility bills, the utility company can make a claim against the bond. The surety company will then pay the utility provider up to the bond's limit. However, the consumer is ultimately responsible for reimbursing the surety company for any claims paid out, plus any associated fees. This means that while the bond provides immediate protection for the utility provider, it also places a responsibility on the consumer to maintain their payment obligations, ensuring that they remain accountable for their usage.

Benefits of Using a Utility Deposit Bond

There are several advantages to using a utility deposit bond instead of a traditional cash deposit. First and foremost, it allows consumers to avoid tying up a large sum of money. This can be particularly beneficial for those who may be moving into a new home or starting a business and need to allocate funds for other expenses. By opting for a utility deposit bond, consumers can redirect their finances toward more pressing needs, such as renovations, furnishings, or operational costs.

Additionally, utility deposit bonds can help consumers build their credit history. By consistently paying their utility bills on time, consumers can demonstrate their reliability to credit reporting agencies, which may improve their credit score over time. This positive payment history can open doors to better financing options in the future, such as lower interest rates on loans or credit cards. Furthermore, as consumers establish a pattern of responsible financial behavior, they may find it easier to qualify for other services that require credit checks, thereby enhancing their overall financial stability.

Who Needs a Utility Deposit Bond in Florida?

While not every consumer will need a utility deposit bond, certain situations may necessitate one. Typically, utility companies require bonds from customers who:

- Have a limited credit history or poor credit score

- Have previously defaulted on utility payments

- Are new to the area and do not have a payment history with the utility provider

In these cases, a utility deposit bond serves as a safeguard for the utility company, ensuring that they will receive payment for services rendered. It's important for consumers to check with their specific utility provider to understand their policies regarding deposit bonds. Additionally, understanding the implications of needing a bond can help consumers better manage their finances, as it may require them to set aside funds that could otherwise be used for immediate expenses.

Moreover, the process of acquiring a utility deposit bond can vary significantly depending on the provider and the individual’s circumstances. For example, some utility companies may allow customers to pay a lower deposit amount if they can demonstrate a steady income or provide references from previous utility providers. This flexibility can be beneficial for those who may feel overwhelmed by the initial costs associated with moving into a new home or apartment.

Common Utility Providers in Florida

Florida is home to a variety of utility providers, each with its own policies regarding utility deposit bonds. Some of the most common utility providers in the state include:

- Florida Power & Light (FPL)

- Gulf Power Company

- TECO Energy

- Orlando Utilities Commission (OUC)

Each of these providers may have different requirements and processes for obtaining a utility deposit bond, so it's essential for consumers to familiarize themselves with their chosen utility company's policies. For instance, Florida Power & Light offers an online portal where customers can easily access their account information and find specific details about bond requirements. Additionally, some providers may offer payment plans or options to waive the deposit after a certain period of timely payments, which can significantly ease the financial burden on new customers.

Furthermore, it's worth noting that utility deposit bonds are not just a one-time expense; they can also impact a customer's long-term relationship with their utility provider. Maintaining a good payment history can lead to better rates, reduced deposits in the future, and even promotional offers. This makes it crucial for consumers to stay informed about their payment obligations and to communicate proactively with their utility providers if they encounter financial difficulties.

How to Obtain a Florida Utility Deposit Bond

Obtaining a utility deposit bond in Florida involves several steps. While the process may vary slightly depending on the surety company and utility provider, the general steps are as follows:

Step 1: Research Surety Companies

The first step in obtaining a utility deposit bond is to research and identify reputable surety companies that operate in Florida. It's essential to choose a company with a solid reputation and experience in providing utility bonds. Online reviews, testimonials, and recommendations from friends or family can be helpful in this process. Additionally, it may be beneficial to check with the Florida Department of Financial Services to ensure that the surety company is licensed and in good standing. This can provide peace of mind, knowing that you are working with a legitimate provider who adheres to state regulations.

Step 2: Gather Necessary Documentation

Before applying for a utility deposit bond, consumers should gather the necessary documentation. This may include:

- Proof of identity (e.g., driver's license or passport)

- Social Security number

- Proof of residence (e.g., lease agreement or utility bill)

- Financial information (e.g., income statements or bank statements)

Having this information ready can streamline the application process and improve the chances of approval. It’s also wise to prepare a brief explanation of your financial history, particularly if you have any past credit issues. This proactive approach can help the surety company understand your situation better and may lead to more favorable terms.

Step 3: Complete the Application

Once the necessary documentation is gathered, consumers can complete the application for the utility deposit bond. This application typically requires personal information, financial details, and information about the utility provider. The surety company will review the application and assess the consumer's creditworthiness.

After the review, the surety company will provide a quote for the bond premium. If the consumer agrees to the terms, they can proceed with the bond issuance. It's important to note that the premium can vary based on factors such as the applicant's credit score and the amount of the bond required by the utility provider. Consumers should take the time to compare quotes from multiple surety companies to ensure they are getting the best possible rate. Furthermore, understanding the terms of the bond, including any potential fees or conditions, is crucial before finalizing the agreement.

Understanding the Costs Involved

When considering a utility deposit bond, it's essential to understand the costs involved. The primary cost is the bond premium, which is typically a percentage of the bond amount. This percentage can vary based on the consumer's creditworthiness and the surety company's policies.

Factors Affecting Bond Premiums

Several factors can influence the bond premium, including:

- Credit Score: Consumers with higher credit scores may qualify for lower premiums, while those with poor credit may face higher rates.

- Bond Amount: The total amount of the bond required by the utility company will also affect the premium. A higher bond amount generally results in a higher premium.

- Financial Stability: A consumer's overall financial situation, including income and debt levels, can impact the premium rate.

Additional Fees

In addition to the bond premium, consumers should also be aware of any additional fees that may be associated with obtaining a utility deposit bond. These can include:

- Application fees

- Processing fees

- Renewal fees (if applicable)

It's crucial to review the terms and conditions provided by the surety company to understand all potential costs involved. Furthermore, some surety companies may offer discounts for bundling multiple bonds or for clients who have a long-standing relationship with them. This can be particularly beneficial for businesses that require multiple bonds for various operations, as it can lead to significant savings over time.

Another important aspect to consider is the duration of the bond. Utility deposit bonds are often required for a specific period, and understanding the renewal process and associated costs is vital. Some consumers may overlook the fact that their bond needs to be renewed annually, which can incur additional premiums and fees. Being proactive about these renewals can help avoid lapses in coverage and ensure continuous service from utility providers.

Renewing and Cancelling a Utility Deposit Bond

Utility deposit bonds are not always permanent; they may need to be renewed or canceled depending on the consumer's circumstances and the utility company's policies.

Renewal Process

Some utility deposit bonds may require annual renewal, especially if the bond is tied to a specific term. Consumers should keep track of their bond's expiration date and contact the surety company for renewal options. In many cases, the renewal premium may be lower if the consumer has established a good payment history with the utility provider. Additionally, some surety companies may offer incentives for timely renewals, such as discounts or loyalty programs, which can further reduce the cost of maintaining the bond.

It's also advisable for consumers to review their financial situation and utility usage before renewing. Changes in income or consumption patterns could affect the bond's terms and premiums. For instance, if a consumer has made significant improvements to their credit score or has been consistently paying their utility bills on time, they might qualify for a more favorable bond rate. Engaging in a proactive conversation with the surety company can yield insights into potential savings and adjustments that reflect the consumer's current financial health.

Cancelling a Utility Deposit Bond

If a consumer no longer requires the bond, they may choose to cancel it. This could happen if they have improved their credit score or if they have established a reliable payment history with their utility provider. To cancel a bond, the consumer must contact the surety company and follow their cancellation process, which may involve submitting a written request. It's essential for consumers to understand the specific requirements set forth by the surety company, as these can vary widely. Some companies may require additional documentation or proof of payment history before processing a cancellation.

It's important to note that canceling a bond does not automatically release the consumer from any financial obligations. If there are outstanding claims or fees, those must be settled before the bond can be canceled. Furthermore, consumers should be aware that some utility companies may have their own policies regarding the release of deposits or bonds, which could involve waiting periods or additional verification steps. Therefore, maintaining open lines of communication with both the surety company and the utility provider is crucial to ensure a smooth cancellation process. Understanding these nuances can help consumers navigate the complexities of utility deposit bonds more effectively.

Common Misconceptions About Utility Deposit Bonds

There are several misconceptions surrounding utility deposit bonds that can lead to confusion for consumers. Understanding these myths can help clarify the purpose and function of these bonds.

Myth 1: Utility Deposit Bonds are the Same as Insurance

One common misconception is that utility deposit bonds function like insurance. While both provide financial protection, they operate differently. A utility deposit bond guarantees payment to the utility company in the event of non-payment by the consumer, while insurance protects the consumer from unforeseen events. Consumers are ultimately responsible for repaying any claims made against the bond.

Myth 2: All Utility Companies Require a Bond

Not all utility companies in Florida require a utility deposit bond. Many companies may allow customers with good credit histories to establish service without a bond. It’s essential for consumers to check with their specific utility provider to determine their requirements.

Myth 3: Utility Deposit Bonds are Expensive

While there are costs associated with obtaining a utility deposit bond, many consumers find that the premium is significantly lower than a cash deposit. Additionally, the bond can provide financial flexibility, allowing consumers to allocate their funds elsewhere.

Conclusion

Understanding Florida utility deposit bonds is essential for consumers who want to establish utility services without the burden of a large cash deposit. These bonds provide a valuable alternative, allowing individuals and businesses to secure their utilities while maintaining financial flexibility.

By researching reputable surety companies, gathering necessary documentation, and understanding the costs involved, consumers can navigate the process of obtaining a utility deposit bond with confidence. Whether moving to a new home or starting a business, being informed about utility deposit bonds can lead to a smoother transition and a more positive experience with utility providers.

Ultimately, utility deposit bonds serve as a bridge between consumers and utility companies, ensuring that both parties are protected and that essential services can be accessed with ease. With the right knowledge and preparation, anyone can successfully navigate the world of utility deposit bonds in Florida.

Article By: Ryan Spalding

Licensed Insurance Agent & Bond Specialist

Contact Us